What is a FICO Score?

This Offer Is Not Available

For people looking to apply for a new credit card or take out a loan, it is especially important to know your credit score. Credit scores are important because they allow lenders to gauge how reliable a borrower is in repaying back debt. Someone with a low credit score will not be eligible for as many credit cards as someone with a high credit score because lenders realize that low credit score cardholders are more likely to default or make late payments on the credit card.

One common credit score report is the FICO score report, which offers reports from all three credit bureaus: Experian, TransUnion, and Equifax.

How can I get a FICO Score Report

There are many ways in which someone can view their FICO score report. Nowadays, some credit card companies even offer free FICO score reports as part of its incentive to get people to use their credit cards.

Normally, you’d go to myFICO to purchase a score report. The price of one report can range from $19.95 - $59.85, depending on how many bureaus you need reports from. So if you have a credit card that offers free FICO score reports, be sure to take advantage of this feature as the price of buying a report yourself can definitely add up over time.

While there are many other credit scores, like VantageScore, FICO is one of the most popular options amongst lenders. So if you’re deciding between a FICO credit score or another credit score, it may be better to choose the FICO credit score because around 90% of top lenders prefer a FICO credit score.

How is my FICO Score Calculated

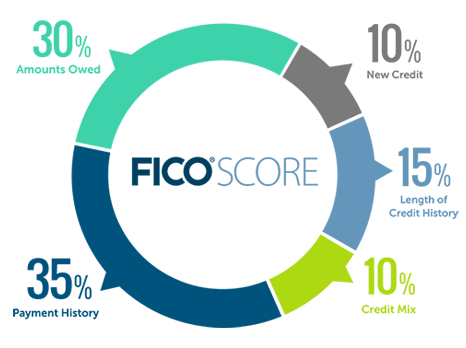

The way your FICO score is calculated can be seen from this diagram, image courtesy of myFico.com:

- Payment History: Payment history shows past lenders whether or not you’ve made your past payments on time. This will help lenders get a general idea of how trustworthy of a borrower you are.

- Amounts Owed: Amounts owed, also known as credit utilization, refers to the percentage of your available credit that you are using. If you are using a high percentage of your available credit limit, this can be negative because lenders will view you as more likely to default.

- New Credit: This refers to the opening of several credit accounts in a short period of time. Lenders will be worried by this because, like high credit utilization, it could increase the risk of default for a borrower.

- Length of Credit History: The length of your credit history also matters because it proves how trustworthy you have been with past credit accounts. Generally, someone with a long credit history will have a higher credit score than someone with a short credit history.

- Credit Mix: As the final component of the FICO credit score, lenders will also consider how diverse your range of credit accounts are, whether that be credit cards, installment loans, or mortgage loans.

The minimum credit score considered to be good by most lenders is 670. So if you are looking to increase your credit line or take out a new credit account, it’s important to maintain a good credit score. You can do this by closely monitoring your FICO credit score and making adjustments to ensure your credit score continues to improve.

FICO vs VantageScore

Another competing credit score reporting agency is VantageScore. Similar to FICO, VantageScore can generate a credit score that predicts whether a borrower will fall at least 90 days behind on their payments in the next 2 years. However, there are slight differences between FICO and VantageScore, specifically in the way in which they calculate their credit scores.

One important difference to note is that VantageScore is not as widely accepted as FICO score reports. This is partly due to the fact that VantageScore was only created in 2008, while FICO scores have been around since 1989.

For FICO credit scores, you also need to have a credit account that is at least six months old in order to receive a credit score. But for VantageScore, the age of the credit account doesn’t matter to create a credit score. Therefore, people with a newly created credit account may want to get their credit scores from VantageScore because they may not meet the credit account age requirement for a FICO credit score.

Conclusion

A FICO credit score is a widely accepted scoring agency that assigns a credit score to a borrower based on a variety of metrics. For lenders reviewing the application of a potential borrower, a FICO credit score can be essential in determining the trustworthiness of an applicant. Someone who repeatedly fails to make their payments on time and has a low credit score will not get approved for as many loans as someone with a better credit score. Consequently, it’s important for borrowers to closely monitor their FICO credit scores to ensure that they are staying within an acceptable range for most lenders.

Serious Security

100% Free